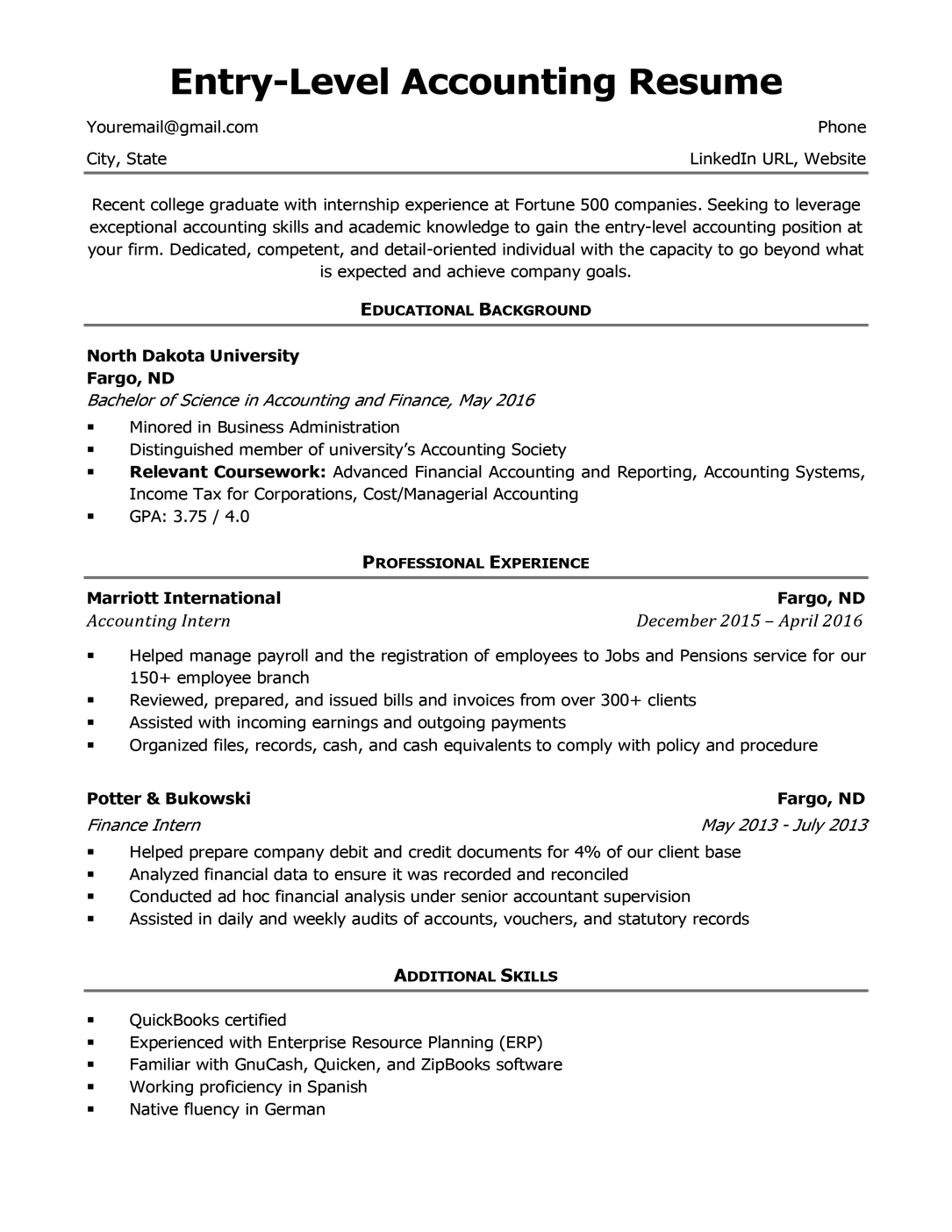

(xxx)-xxx-xxxx | your@email.com | 123 Your Address, City, State, Zip Code

Recent college graduate with internship experience at Fortune 500 companies. Seeking to leverage exceptional accounting skills and academic knowledge to gain the entry-level accounting position at your firm. Dedicated, competent, and detail-oriented individual with the capacity to go beyond what is expected and achieve company goals.

Educational Background

North Dakota University, Fargo, ND

Bachelor of Science in Accounting and Finance, May 2016

- Minored in Business Administration

- Distinguished member of university’s Accountant Society

- Relevant Coursework: Advanced Financial Accounting and Reporting, Accounting Systems, Income Tax for Corporations, Cost/Managerial Accounting

- GPA: 3.75/ 4.0

Professional Experience

Marriott International, Fargo, ND

Intern, December 2015 – April 2016

- Helped manage payroll and the registration of employees to Jobs and Pensions service for our 150+ employee branch.

- Reviewed, prepared, and issued bills and invoices from over 300+ clients.

- Assisted with incoming earnings and outgoing payments.

- Organized files, records, cash, and cash equivalents to comply with policy and procedure.

Potter & Bukowski, Fargo, ND

Finance Intern, May 2013 – July 2013

- Helped prepare company debit and credit documents for 4% of our client base.

- Analyzed financial data to ensure it was recorded and reconciled.

- Conducted ad hoc financial analysis under senior accountant supervision.

- Assisted in daily and weekly audits of accounts, vouchers, and statutory records.

Additional Skills

- QuickBooks certified

- Experienced with Enterprise Resource Planning (ERP)

- Familiar with GnuCash, Quicken, and ZipBooks software

- Working proficiency in Spanish

- Native fluency in German